Mergers & Acquisitions

A majority of mergers fails despite lots of experts convinced that the merger will be a great success.

Mergers & Acquisitions are fascinating

Mergers & Acquisitions aim at generating multiples. Every significant investment is worthwhile as long as the target has been well selected and the process is completed successfully. Investments in banks and consultants are significant. However, the success of an M&A process relies on getting a few more things right as well. McKinsey lists the top 10 areas to consider and recommends the application of powerful tools.

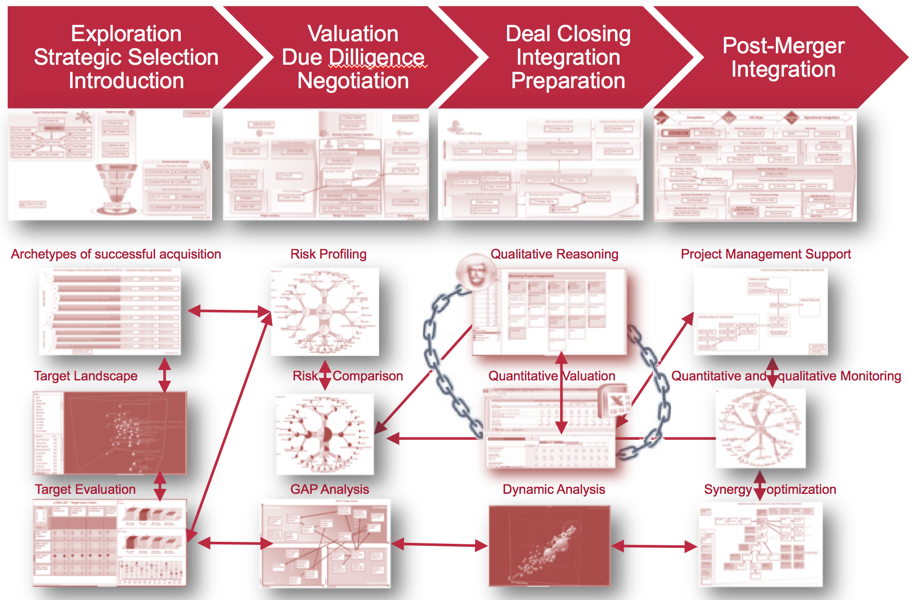

EIDOS Merger & Acquisition Template

The reason for the failures are obvious and quickly identified: complexity, uncertainty and weak risk management throughout the entire process including the Post-Merger-Intergation (PMI) phase. McKinsey has listed 10 "must haves" for M&As.

10 "must haves"

for Mergers and Acquisitions

Please point and hover to the progress bar to get additional hints.

M&A must haves*:

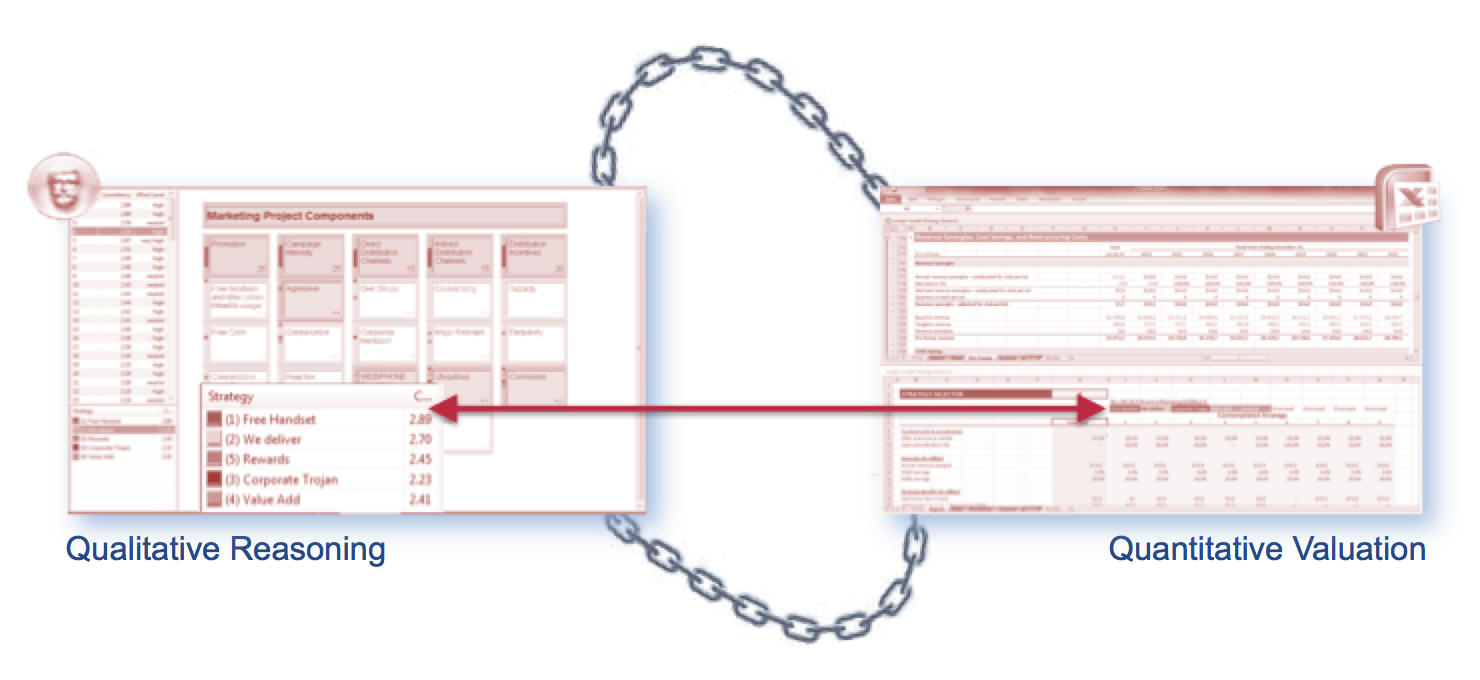

...and the potential added value of EIDOS